Understanding the business cycle is essential for navigating economic landscapes. You’ll notice how each phase—expansion, peak, contraction, and trough—affects production and employment rates. Key economic indicators like inflation and unemployment signal shifts that impact both businesses and consumers. Moreover, policymakers play a crucial role in these cycles. But what strategies can you employ to adapt to these fluctuations effectively?

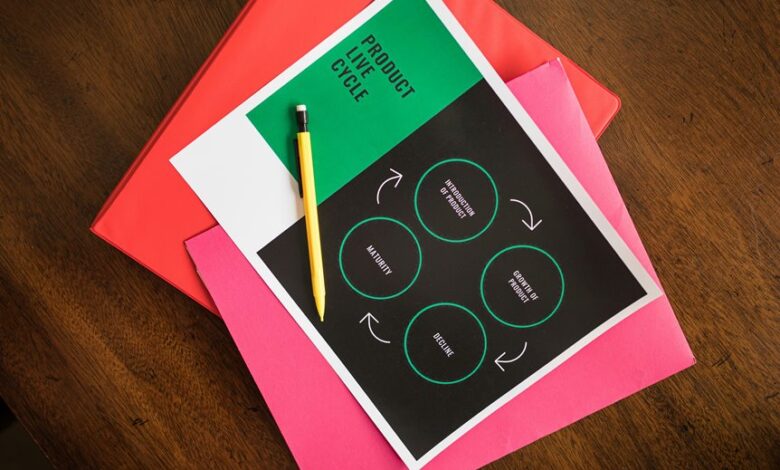

Phases of the Business Cycle

The business cycle consists of four distinct phases: expansion, peak, contraction, and trough.

During the expansion phase, economic growth accelerates, leading to increased production and employment.

Conversely, the contraction phase marks a decline in economic activity, often resulting in reduced spending and job losses.

Understanding these phases helps you navigate economic fluctuations and make informed decisions that align with your desire for financial freedom.

Key Economic Indicators

Understanding the phases of the business cycle lays the groundwork for recognizing key economic indicators.

Inflation rates and unemployment trends offer critical insights into economic health. Rising inflation may signal overheating, while increasing unemployment often indicates contraction.

Impact on Businesses and Consumers

As businesses navigate the fluctuations of the business cycle, the impact on consumers becomes increasingly evident.

Changes in consumer behavior directly influence business strategies, compelling companies to adapt quickly. During economic expansions, consumer spending rises, prompting firms to invest more.

Conversely, in downturns, cautious spending leads to strategic adjustments to maintain profitability and meet shifting demands, ultimately shaping the market landscape.

Role of Policymakers in Economic Cycles

While economic cycles are often influenced by market forces, policymakers play a crucial role in shaping the trajectory of these cycles through fiscal and monetary measures.

By implementing effective fiscal policies, they can stimulate demand and boost growth during downturns.

Similarly, monetary policies can adjust interest rates, influencing borrowing and spending.

These interventions help stabilize the economy, promoting sustained growth and maintaining individual freedom.

Conclusion

In navigating the business cycle, you must remain vigilant and adaptable. Just as a ship adjusts its sails to the shifting winds, understanding these economic phases empowers you to make informed decisions. Recognizing the indicators of expansion and contraction can help you seize opportunities or mitigate risks. Ultimately, your awareness of these dynamics not only positions you for success but also fosters resilience in the face of inevitable economic fluctuations.